Affiliate Disclosure: The owners of this website may be paid to recommend the following companies: Goldco, Augusta Precious Metals, Noble Gold Investments, and Birch Gold. The content on this website, including any positive reviews of the mentioned companies, and other reviews, may not be neutral or independent.

Retirement investors need to do everything possible to protect their wealth from market volatility and inflation in today’s markets.

Experts in economics and investment recommend that a portion is converted to assets that don’t correlate with the dollar’s health, such as precious metals. You can convert a part of your 401k to physical silver bullion or IRA. The Gold IRA rollover is a process that allows investors to convert a portion of their IRA holdings to physical precious metals. It’s becoming very popular with diversification and wealth protection investors.

Table of Contents

Buyer Beware! Gold IRAs are Unregulated!

A Gold IRA lets you own physical precious metals on a tax-deferred, or tax-free basis. The Gold IRA rollover allows for easy creation and funding of such an account through the transfer of assets or cash from an IRA.

We have created this guide on how to rollover a Gold IRA. This allows you to convert stocks, bonds, or ETFs into precious metallics. All this is possible within a Tax-Advantaged Retirement Account like a self-directed Roth IRA.

What is a Gold IRA Rollover?

Rollovers to a Gold IRA are when part of an existing retirement or investment account (e.g., 401k, Roth IRA, or SEP IRA), is converted into bullion bars or gold coins as a hedge against economic uncertainty or inflation. Funds are withdrawn from your existing account during a rollover and must be held for 60 days before being redeposited into your new IRA.

Gold IRA rollover vs. Gold IRA transfer

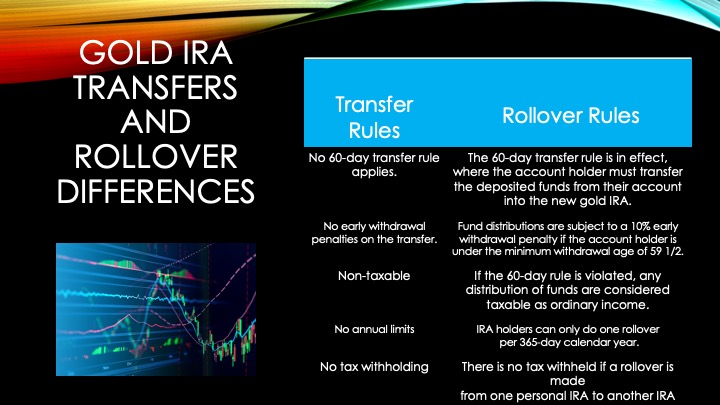

Two options are available to investors when funding a Gold IRA. A rollover or a transfer. Simply put, a transfer allows for the safest and most risk-managed method of moving assets between retirement savings funds. Investors must be aware of the many rules and conditions that apply to Gold IRA rollovers. These rules can lead to penalties for account holders who violate them. Rollovers have fewer rules that apply to transfers.

Below we have listed the key differences in Gold IRA transfers and rollovers along with some core similarities.

How it Works

A Gold IRA Transfer (sometimes referred to as an “IRA Gold Transfer”) is a transfer of funds from one custodian to another. Money is not taken directly out of the investor’s account. Funds are transferred to third parties without the account holder being involved. It’s an easy, straightforward process that doesn’t require any involvement from the account holder and is handled entirely by the custodians.

The difference between transfers and rollovers is that the distributed money does not reach the IRA holder’s accounts in the case of IRA transfer. You can find more information about rollovers and the penalties for breaking them in this guide by the IRS to general IRA Rollovers. This gold IRA FAQ section is a great way to learn more from Uncle Sam.

Many prefer an IRA-gold transfer because it reduces the chance of human error in comparison to a rollover. It is possible to create problems with a rollover by failing to transfer the funds to your new account in time. The IRS could impose a substantial financial penalty if you fail to comply. However, gold IRA transfers are exempt from this penalty since they are handled automatically by the account custodian.

401K-to-Gold IRA Rollover

It is possible to rollover or transfer funds from an employer-sponsored 401(k) or self-directed 401 (k) to a Gold IRA, contrary to some investors’ beliefs. This is possible, but there are some differences that need to be clarified before you can proceed.

There shouldn’t be any problems rolling over funds from a 401k sponsored by an ex-employer to a new Gold IRA. Choose a new IRA Gold custodian, and they will initiate the 401 (k)-to IRA rollover. Rolling over to a self-directed IRA is more difficult if your 401(k), is currently sponsored by your employer.

You should review the terms and conditions of any 401(k), sponsored by your current employer. Sometimes employer-sponsored retirement plans (401(k),) don’t allow you to invest in gold while you are employed. Talk to your employer to find out the rules for your current 401(k). Also, ask about whether rollovers or transfers to a Gold IRA are permitted.

You can rollover a current employer 401(k) into a new Gold IRA. This article provides a more detailed description of the process. This guide will help you to manage employer-sponsored rollovers of 401(k).

Our Top Recommended Gold IRA Company

Choosing a Gold IRA Rollover Strategy

There is no one-size fits all approach to investing in a Gold IRA. Your financial plans will influence the rollover strategy you choose for funding your account.

How much money you have available to fund precious metals such as gold and silver depends on how risky you are and where you live. Investors who don’t want to take on excessive risk and who are less than ten years away from their retirement age might be better off putting 15-20% of their portfolio towards precious metals.

To hedge against wider market instability, you can supplement your portfolio with alternative assets, such as gold, silver, or cryptocurrencies. As market uncertainty continues to cloud traditional markets, investors are increasingly diversifying with uncorrelated assets, such as gold.

Choosing your Gold IRA Allocation

The 5-10% rule has been a staple of success for some of the best investors around the globe (e.g., NBC Shark Tank’s Kevin O’Leary, Tony Robbins, and Ray Dalio). But there is a risk-averse investor who recommends that you go beyond that level. The following questions can help you make a decision.

- What are my views on the economy overall over the next 5-10 Years?

- Have my portfolio performed as expected over the last five years?

- What is the true purpose of investing in precious metals (e.g. profit diversification, risk management, and risk management)?

- How close can I be to my retirement date?

Particularly interesting is the third question. This should make you look within to discover your true intentions. Our research shows that most of our readers’ responses fit within the three main orientations that define investor motivations for opening a Gold IRA.

Diversification Strategy

The diversification strategy is for those who are looking to diversify their portfolio by investing in precious metals. This protects them from excessive exposure to stocks, bonds, and other traditional assets. To limit losses from a stock market decline or recession, many risk-conscious investors diversify with precious metals.

This strategy is ideal for a 5-10% allocation to precious metals. This means that investors should think about putting roughly 10% of their portfolio into precious metals holdings like gold, silver, and platinum. For investors who have such high-risk tolerance, it is likely to be too conservative to allocate more than this percentage for these assets.

Protection During High Inflation

Investors worried about currency debasement or widespread inflation might consider putting more money into gold and silver. An IRA rollover of gold can help investors protect their wealth against a declining U.S. dollar.

The U.S. currently faces a severe inflation threat. In April 2021, the country saw its highest-ever year-over-year CPI growth ( +4.2%). This was after September 2008’s high. During the 1970s notorious era of inflation, the

In other words, panic can cause gold to rise. In March 2020, for example, the price of gold soared to a seven-year high during an OPEC+ oil crisis. Despite a stock market selloff, gold prices increased by +1.4% during the notorious U.S./Iran airstrike in January 2020.

Investors looking for systemic protection from war and collapse should look into precious metals. This orientation suggests that 20 to 30% of gold assets be used as the highest allocation.

Top Gold IRA Companies

Our recommended Providers are researched and vetted by us and many top consumer organizations. This is the short list of the most consistent companies we could come up with. Request information from them below.

#1: Augusta Precious Metals

Our Rating: 10/10

Pros

✅ ZERO complaints with the BBB and BCA

✅ Highest reputation and customer satisfaction in the industry

✅ Non-commissioned sales team

✅ Transparent pricing with up to 10 years of fees waved – with qualifying purchase.

✅ Hall of fame quarterback, Joe Montana was an actual customer before becoming their spokesperson!

Get a free gold IRA Kit now!

Call: 1-855-470-4636

#2: Birch Gold Group

Our Rating: 9.9/10

Pros

✅ Great company commitment to education and communication

✅ Impeccable customer service

✅ Silver, gold, platinum and palladium available

Cons

❌ Signup process can only be done thought a specific link

❌ Certain fees are not disclosed up front

❌ No buyback guarantee of precious metals

#3: Noble Gold Investments

Our Rating: 9.6/10

Pros

✅ One of the best no questions asked buyback programs in the industry

✅ Free delivery of your precious metals to your door at any time

✅ Over 20 years of experience in the precious metals industry

✅ Gold, silver, platinum, and palladium available

✅ One of the lowest barriers to entry – ideal for smaller investors

Cons

❌ High annual fees for low balances

Gold IRA Rollover: Choose from IRS Approved Bullion Bars

The IRS sets strict guidelines about the types of gold assets that can go into a tax-advantaged retirement fund. Check out this guide to IRS authorized precious metals for a complete list.

You can not store collectibles in any IRA, 401(k), or other qualified plan. This is per IRS regulations. Any type of rare coinage, or any precious metal classed as a collectible under IRC section 401(a), is strictly forbidden from any IRA. If you store gold bullion bars they are exempt and are not considered a collectible. Three key exceptions apply to coinage. invest in gold coins using a Gold IRA rollover.

- Certain coins described under 31 USC Section 5112

- Coins are issued and minted under the laws of any sovereign state

- Bank or non-bank trustees have coins or bullion.

There is a possibility of facing penalties or fines for investing in unapproved assets. You can be safe and invest in gold bullion instead of rare coinage. If you are determined to invest in gold coinage, be sure to thoroughly review our list of IRA-approved gold coins.

Two Types of Gold Exposure

There are two types of exposure to gold. The first is physical gold bullion. This is a description of cold, hard-metal bars that are kept safe by trusted third-party custodians. The second also called “paper” or “gold” refers to any type of security that is gold-based, such as an ETF, gold mining stock, or ETF.

Paper gold is more convenient than real metal bullion for many reasons, including convenience. Gold stocks are often praised by investors for their increased liquidity. However, this can come with a cost. It is easier to purchase and sell assets quickly if you have greater liquidity. Paper gold is therefore more volatile than physical commodities.

Physical Gold IRA Rollover is Usually the Best

A physical Gold IRA rollover is a good idea if you want to fully experience the benefits of investing in gold. If there is runaway inflation or a complete economic collapse, your gold stocks might be worth less than the paper on which they were printed.

Are you still looking for a way to sell your physical gold? We have listed below some of the top benefits of investing in physical gold compared to gold-based securities exposure.

- Counterparty Risk: Unlike a publicly-traded stock, a gold bar cannot declare bankruptcy or fail to honor its contractual obligations–therefore, physical gold investors are free from the same counterparty risks as paper gold investors.

- Safe Haven Store Value: Physical gold bullion is a last resort store value in times of economic crisis.

- Physical Ownership Precious metal bars are yours, making it much harder to seize them or take them away than electronic assets.

- Transferring & Movable: Gold bars are mobile and can be withdrawn to your IRA in your own hands, or into a vault as a distribution.

These are not only benefits for precious metals; they also make gold and other metals a worthy choice for many investors.

Finding the Best Gold IRA Custodian

To open a Roth or Traditional IRA, all you have to do is drive to your Vanguard or Fidelity Investments branch. There you can apply for a new IRA right away. Gold IRA rollovers, however, are a little more complex.

Fidelity and Charles Schwab are not authorized to open Gold IRAs. It is necessary to find a Gold IRA Custodian in order to open a Gold IRA. This company will help you rollover your Gold IRA with your existing IRA and 401(k). A trusted custodian will work alongside you to ensure your holdings remain safe and compliant with IRS regulations.

Trustworthy Gold IRA firms assist with the entire rollover process. These companies are completely transparent and provide all the documentation and paperwork required to complete the rollover.

You can find a list of the top Gold IRA Rollover Companies to help you get started. There are a few things you should keep in mind when looking for a Gold IRA Custodian.

1. Gold IRA Company with a Solid Reputation

A company with a strong reputation and a positive customer experience profile is a must when looking for a Gold IRA supplier. Unfortunately, some companies have malicious intents that prey upon unsuspecting customers.

Avoid any precious metals company with poor online reviews. YouTube, Google My Business (Google Trustpilot), Reddit, and the Better Business Bureau, (BBB), are great places to find genuine customer reviews and testimonials.

The operative word here is “authentic”. Unfortunately, paid reviews can be published on social media by some companies. If reviews are short and do not provide any substantive information, it is a sign that they are fake.

You must be aware that only IRS-approved, nonbank trustees may operate a precious metals vault. You should consider another alternative if your custodian fails to mention that they are IRS-approved. Some vendors will sell low-purity, numismatic, or even non-IRA-approved gold. Our IRA-approved precious metals company recommendations will help you avoid scammers.

Top Gold IRA Companies

Our recommended Providers are researched and vetted by us and many top consumer organizations. This is the short list of the most consistent companies we could come up with. Request information from them below.

#1: Augusta Precious Metals

Our Rating: 10/10

Pros

✅ ZERO complaints with the BBB and BCA

✅ Highest reputation and customer satisfaction in the industry

✅ Non-commissioned sales team

✅ Transparent pricing with up to 10 years of fees waved – with qualifying purchase.

✅ Hall of fame quarterback, Joe Montana was an actual customer before becoming their spokesperson!

Get a free gold IRA Kit now!

Call: 1-855-470-4636

#2: Birch Gold Group

Our Rating: 9.9/10

Pros

✅ Great company commitment to education and communication

✅ Impeccable customer service

✅ Silver, gold, platinum and palladium available

Cons

❌ Signup process can only be done thought a specific link

❌ Certain fees are not disclosed up front

❌ No buyback guarantee of precious metals

#3: Noble Gold Investments

Our Rating: 9.6/10

Pros

✅ One of the best no questions asked buyback programs in the industry

✅ Free delivery of your precious metals to your door at any time

✅ Over 20 years of experience in the precious metals industry

✅ Gold, silver, platinum, and palladium available

✅ One of the lowest barriers to entry – ideal for smaller investors

Cons

❌ High annual fees for low balances

2. Rollover Limitations

Remember that IRS only allows one rollover without penalty per 365 days. You should choose your custodian carefully. If you choose to change custodians after the 12-month period expires, you could be subject to an early distribution penalty if your funds are transferred over again.

It can be difficult choosing the right precious metals IRA company for you. There are so many on the market. This is why we have compiled a quick list highlighting the top ten most trusted companies in this industry. Each one has been in business for over a decade.

For gold storage fees, expect to pay between $100 and $325 per year from a reputable provider. Companies will offer promotions from time to time. It’s best to check with our recommended providers for more information.

To get a better understanding of the best custodians in the market, check out our reviews of the top ten Gold IRA provider today. Here you will find a comprehensive breakdown of the nation’s top-reviewed Gold IRA rollover firms, as well as a list of five key considerations when you shop for a Gold IRA rollover.

Eligible account types for a Gold IRA Rollover

For a Gold IRA rollover you can transfer funds to any existing tax-advantaged retirement accounts, including the following:

- Traditional or Roth IRA

- Self-directed 401(k)

- Employer-sponsored 401(k)

- SEP IRA

- 403(b)

- 457(b)

- TSP

You may be required to facilitate the rollover of employer-sponsored accounts (e.g. 401(k), 457(b)) after you terminate your employment. Rollovers from one account are not allowed by some employers. Some employers allow partial rollovers after 59.5 years.

It is easy to move funds from an existing account into a new Gold IRA by simply registering a self-directed IRA through a Gold IRA supplier. Fill out a transfer request form in order to initiate the rollover process. Usually, funds appear in the new IRA within 14 working days.

A gold IRA rollover is a type of Individual Retirement Account (IRA) that allows investors to hold physical gold bullion in their retirement portfolios. Investors can roll over funds from an existing IRA or 401(k) into a gold IRA, or open a new account.

With a gold IRA, you have the flexibility to purchase and sell your holdings at any time. Unlike investing in traditional IRAs and 401(k)s, with metal IRAs, you have the ability to be exposed to both long-term investments like stocks and bonds as well as short-term investments like precious metals.

A gold IRA rollover is when you move your retirement savings from a traditional IRA or 401k into an account that invests in gold. This can be done by transferring the money from your current account to a gold IRA company, which will then buy gold on your behalf and hold it in a safe for you. Rolling over to a gold IRA can be a good way to diversify your retirement portfolio and protect your savings from inflation. Plus, with recent changes in the tax code, it may even help you save on taxes. Here’s how to do a gold IRA rollover:

You can start with your current employer or former employer’s 401k plan administrator to find out what steps you need to take and what forms you need to fill out. The specifics will vary from plan to plan, but typically your current account provider will provide information about how to roll your retirement savings into a gold IRA, including any costs involved. Once you’ve determined that it’s worth it for you financially, all that’s left is moving your money into an account at a gold IRA company. If you want more control over how your money is invested than offered by most traditional 401k plans, rolling over may be a good option for you. Check with financial advisors if you’re not sure whether it would be beneficial for you.

A gold IRA rollover is when you move your retirement savings from one account to another. This can be done for a number of reasons, but most often it’s done to take advantage of better investment opportunities or to consolidate accounts. You can roll over your traditional IRA, Roth IRA, 401(k), or 403(b) into a gold IRA. And yes, you can use your rollover IRA to buy gold.

As long as you have gold IRA rollover eligibility, you can purchase as much gold as you want with your account. For some investors, it makes sense to buy gold through their rollover IRA since they can take advantage of tax-deferred or tax-free gains when they sell their metals in retirement. One note: If you’re going to hold on to your metals for a long time (more than 12 months), it might make more sense to hold them in an ordinary brokerage account where there are no required minimum distributions and no income tax on your profits if you choose not to sell.

An Individual Retirement Account (IRA) is a personal savings plan that offers certain tax advantages. An IRA rollover occurs when the assets in your current IRA are transferred to another IRA. The rules for rollovers are simple: you must complete the transfer within 60 days, and you can only roll over assets from one IRA to another once per year. There are two types of rollovers: direct and indirect. A direct rollover happens when the money is transferred directly from one IRA to another. An indirect rollover occurs when the money is first withdrawn from one IRA and then deposited into another.

In most cases, you’ll have to pay taxes and penalties if you don’t complete your rollover within 60 days. However, in some cases, such as military deployment or disability, you may qualify for more time. If you do miss that deadline, though, there are ways to avoid being penalized and paying unnecessary taxes.

In general, you won’t be able to directly roll over any portion of an inherited IRA.

You can contact a gold IRA company like Goldco to set up your account. The process is simple and straightforward. You will need to fill out some paperwork and choose how you want to fund your account. Once your account is funded, you can start buying gold.

When you are ready to buy gold, you can do so from your account online. Your gold will be shipped directly to you within 2 business days. Typically it will arrive before you know it. Once it arrives, you can start enjoying your new investment! It’s important to remember that as a special type of self-directed IRA, there are some limitations and rules that must be followed with your gold IRA rollover. Each individual situation is different, so make sure you read up on what works best for your situation before making any decisions that could have tax or financial repercussions.

IRA approved gold must meet certain fineness standards set by the Internal Revenue Service. The most popular types of gold bullion include bars, rounds, and coins. Each type of gold has different characteristics that can affect its value and how it is stored. When deciding which type of gold to rollover into your IRA, you will need to consider these factors as well as your investment goals.

If you are considering buying gold as an investment, it’s important to make sure that your gold meets IRS requirements for IRAs. It should have fineness of at least .995 and should have unique serial numbers on each piece. Coins with special features or low mintage may be more desirable to collectors, but they may also limit their use in retirement accounts. Precious metals may be subject to capital gains taxes if held for less than one year and collectibles taxes if held for more than one year. If you are using precious metals as collateral on a loan or estate planning, consult an attorney or accountant before purchasing them.

Pingback: Investing in Gold IRA Funds - Gold IRA Rollover

Pingback: How to Convert 401k to Physical Gold - Gold IRA Rollover

Pingback: Gold IRA Guide 2022 - Gold IRA Rollover Guide

Pingback: Gold IRA Guide - Gold IRA Rollover Guide

Pingback: Can You Put Gold in an IRA? - Gold IRA Rollover

Pingback: Convert TSP to Gold IRA - Gold IRA Rollover

Pingback: How To Move Your 401K To Gold Without A Penalty - Gold IRA Rollover

Pingback: How a Gold IRA Works 2022 - Gold IRA Rollover

Pingback: Setting up a Gold IRA - Gold IRA Rollover

Pingback: Tax Free Gold IRA Rollover Guide - Gold IRA Rollover

Pingback: Investing in a Gold IRA For Retirement Planning - Gold IRA Rollover

Pingback: Gold IRA Rollovers Guide - Gold IRA Rollover

Pingback: How to Convert Your 401k to Physical Gold

Pingback: How to Set Up Your Own Gold IRA Account

Pingback: Augusta Precious Metals Review - Gold IRA Rollover

Pingback: The Benefits of a Gold IRA Transfer - Gold IRA Rollover

Pingback: Should I Convert My 401k to Gold? - Gold IRA Rollover

Pingback: How to Transfer 401k to Gold IRA - Gold IRA Rollover

Pingback: Gold IRA Rollover Guide - Gold IRA Rollover

Pingback: Adding Gold to IRA - Tax Implications and Costs

Pingback: Why a gold IRA Investment is a Smart Retirement Savings Strategy