Affiliate Disclosure: The owners of this website may be paid to recommend the following companies: Goldco, Augusta Precious Metals, Noble Gold Investments, and Birch Gold. The content on this website, including any positive reviews of the mentioned companies, and other reviews, may not be neutral or independent.

You’ve probably heard that gold makes an excellent investment, but you may not know why this is the case. There are several reasons to buy gold as an investment, and many of them have to do with its rarity, its intrinsic value, and the historical price movements of the commodity. Here are three main reasons why gold can be a good investment opportunity.

Table of Contents

The many uses of Gold

The uses of gold are extensive and it has been used for trade for centuries. Gold is desired by many cultures around the world as it offers some pretty solid economic properties such as: durability, easiness to use, fungibility and stability in value. This alone make gold valuable, but what about its other uses? From electronics to dentistry, from jewelry to solar panels, from military materials to radiation shielding there are more reasons than one why gold makes an excellent investment.

- In Goldrush-era America miners would literally fill their pans with dirt and shake them onto sheets of canvas so that the heavy particles would sink into troughs where they could be collected.

- Gold can be mixed with other metals to produce an alloy that enhances and strengthens them while also decreasing their weight. This has been used in dentistry, electronics and manufacturing of certain tools.

- It has also been used in airplane parts, industrial magnets and high-energy lasers. Its properties make it uniquely useful for certain applications. The uses of gold are even now being discovered as it is an extremely malleable metal that can be pressed into thin sheets allowing for use in solar panels. This makes gold extremely useful when it comes to energy conservation and efficiency.

- Gold can be used as an anti-radiation material for X-ray and gamma ray protection. Anti-radiation materials are designed to shield people from radiation and one such technology uses gold coating on titanium, zinc or lead plates to protect from nuclear radiation. The uses of gold in non-metallic applications continue to be discovered today, making it even more valuable as a commodity. It’s also important to note that these different uses of gold create additional demand for it and keep its value high for many years to come.

- In addition to its physical uses, gold has become an extremely valuable commodity in today’s world. Gold can be bought and sold through most major investment firms, stock markets and private buyers. Gold exchanges are common around the world and open for 24 hours per day creating a constant stream of trades. The trade of gold even happens electronically which means that you can have your money converted into its value within seconds from any computer or smartphone connected to internet. Some people actually keep their savings in gold bars because it is seen as safe haven in times of financial crises as well as political uncertainty.

Gold is a Good Investment

The increasing value of gold in today’s market

Right now, gold has been steadily increasing in value for the past few years. Just because of this upward trend, many are jumping at the chance to invest in it. For some, their motivation may be short-term, whereas others may view gold as a long-term investment. Whatever your reasoning behind investing in gold is, it will do well and hold its worth if taken care of properly. Steps to take if you’re interested in purchasing precious metals:

- research

- plan

- purchase

- prepare

- store

- sell

- track

- review

- repeat. Gold is an excellent investment and can be particularly good for those who are looking to diversify their portfolios, especially in case of market drops. While you should never put all your eggs in one basket, gold—with its limited supply and increasing demand—is a reliable investment that will protect you from market fluctuations.

- Appreciate. Every time you purchase gold, enjoy it. Know that you have something of value, be proud of your investment, and know that it will appreciate over time if you treat it right. Gold isn’t just a tool for financial gain; it’s an investment in something worth appreciating. Gold bars and gold coins are stunning pieces to add to your collection, no matter what they’re worth at any given time—if they’re worth anything at all! The most important thing is that you can take pride in knowing exactly where your money went: into pieces of artwork that many admire and want to invest in as well. Gold, on top of being a sound investment for your future, also has the potential to make you richer than ever before. So don’t let this opportunity pass you by and start accumulating wealth today!

Our Top Recommended Gold IRA Company

How to invest in physical gold

In order to invest in physical gold, you need to choose which type of form you want the metal to take. There are four major types of gold bullion for sale: ingots, rounds, coins and bars. Ingots measure 1 ounce (30 grams) each, so you can buy as many as your budget allows. Rounds weigh up to one troy ounce (31.1 grams) and come in a range of sizes from 1/10th-ounce coins up to 5 ounces. These are typically pre-1933 US coins that have been reshaped or recast into rounds with the outer layer removed so they weigh exactly one troy ounce.

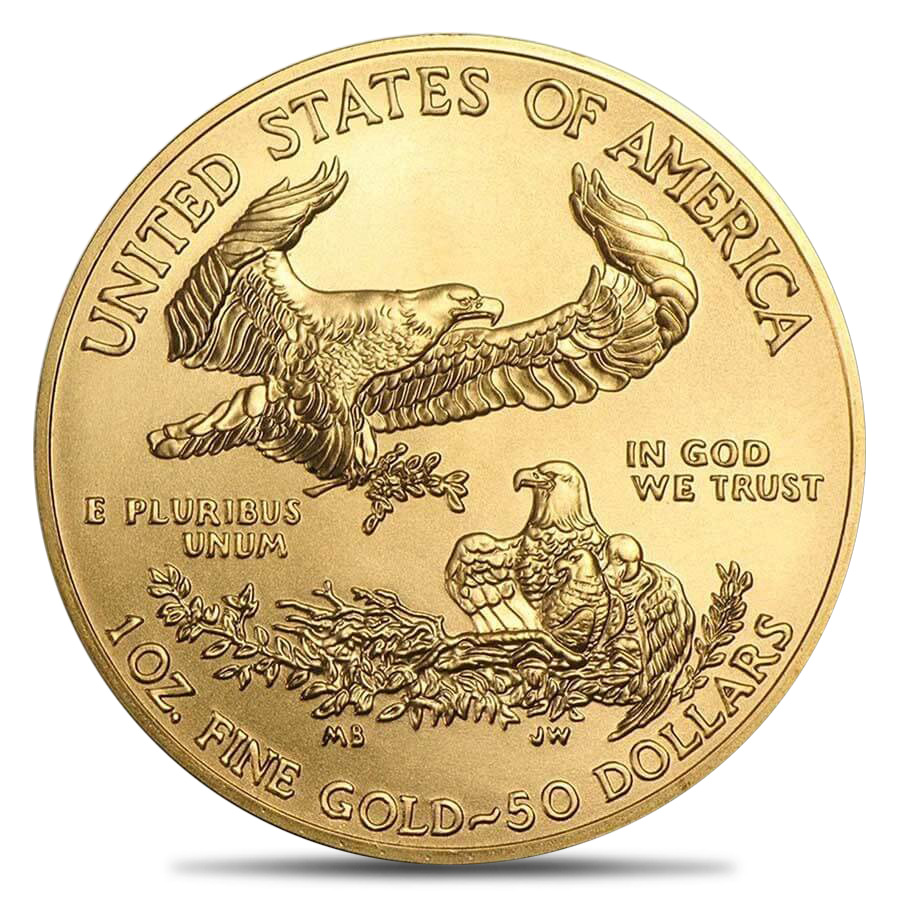

You can buy coins minted by governments and central banks or private mints. Some popular coins include Krugerrands, American Eagle and Maple Leaf. The value of all gold coins — except bullion coins, which are valued by their weight in gold — are more strongly influenced by supply and demand in physical markets around the world. A common alternative to gold coins is gold bars, often called ingots. Gold bars for sale range from 100 grams (3.215 ounces) up to 1 kilogram (32.15 ounces). Because they’re uniform in size, these bars can trade at lower premiums than irregularly sized or weighed gold bullion products like rounds or Krugerrands do due to lower fabrication costs and processing fees with less variance between refiners.

Gold is a Good Investment

How to invest in gold stocks

Investing in gold stocks may be another avenue for long-term investment opportunities. When investing in gold stocks, it is important to keep in mind that shares are more volatile than gold, and have price fluctuations based on supply and demand as well as current world economic climate. There are risks involved with investing in any form of commodity but if you take your time and do the research, you can reduce the risk to an acceptable level. One way to reduce these risks and increase the chances of profits from this type of investment is by diversifying your portfolio with gold stocks alongside other commodities.

You can invest in gold stocks through a direct stock purchase. In order to do so, you’ll need to set up an account with a broker or investment adviser that specializes in stock investments. Before you make your first transaction, be sure to read and understand all of your broker’s fees and commissions, as well as any associated restrictions on trading and selling. Also be aware that each brokerage firm sets its own rules for investing in stock options, including what documents are required when opening an account, how long it takes for accounts to become operational once funds have been deposited and more. As always, thoroughly review all relevant information from potential brokers before deciding where you want to invest your money.

Tax implications of owning physical gold versus stocks

There are no income tax consequences when purchasing and selling gold coins, bars, or certificates. This includes dividends or interest as well as gains from appreciation in the gold’s value.- One of the best benefits of owning physical gold is that you do not have to pay capital gains taxes on any investment profits you make. You only have to pay capital gains taxes if you sell your physical gold for more than what you paid for it. If you buy it for $1,000 and the price goes up to $2,000 and then sell it at $2,000, you would owe capital gains taxes on that difference.- Ownership also protects your investments from inflationary monetary policies.

As with any investment, before buying gold you should have an understanding of your overall financial situation, including your risk tolerance and investment horizon. Understanding these factors will help you make an informed decision about whether gold is right for you.

Buyer Beware! Gold IRAs are Unregulated!

Tips for buying your first (or next) piece of precious metal

If you’re considering buying gold for the first time, you might be wondering why it would be worth it to buy precious metals as an investment. It’s simple: there are many benefits of investing in gold and other precious metals, and these benefits will continue to exist throughout your lifetime. In this post, we’ll explore some of the top reasons that you should invest in precious metals like gold and silver today.

- Inflation Protection – Gold historically maintains its value during times of high inflation while fiat currencies lose their value.

- High Demand and Low Supply – Gold continues to be an appealing investment due to its widespread global appeal. Although there are many other precious metals available, gold is still considered to be far more valuable than others in terms of purity and rarity. Additionally, gold’s intrinsic value makes it one of the most requested items during times of crisis. People throughout history have viewed gold as a safe haven against hardships, so today people view it as protection against difficult financial situations.

- Portfolio Diversity – While gold doesn’t correlate to other asset classes, such as stocks and bonds, it does offer portfolio diversification that can contribute to your long-term wealth. Gold isn’t a good investment in isolation; instead, it should be used in tandem with other assets. For example, some investors purchase gold coins and jewelry to complement their investments in stocks and bonds. When they sell these precious metals, they can earn profits while using them as an insurance policy against economic turmoil. Other people keep their investment money in cash while having their gold coins as part of their larger portfolio because they appreciate both forms of currency. In either case, you’ll want to carefully choose which type of gold will work best for you.

- Collectible Value – Although gold isn’t widely used as currency today, it was once a common medium of exchange. The ancient Egyptians and Romans used gold to pay their workers, and they created coins with which they could buy goods and services. Today, many people collect gold coins that are more than 1,000 years old. Because of its history as money, there is likely to be continued demand for these items among coin collectors. If you plan on collecting gold coins or jewelry instead of selling them in order to make money down the road, then you’ll want to carefully choose your purchases based on their collectible value instead of just their investment value.

- Diversification of Your Portfolio – Because gold and other precious metals tend to do well when other investments, such as stocks and bonds, aren’t doing so well, they can be good choices for those who have conservative portfolios. While gold has historically risen in value during periods of deflation or recession, it may not be a good investment if you’re looking for growth because it tends to follow inflation trends instead. This means that you should use precious metals as part of your overall financial strategy; don’t rely on them as your only income source.

Gold is a Good Investment!

The trustworthiness of buying online

Buying gold online has become a popular option for those who want to add some protection to their portfolio. These days, shopping online has become such an easy way to purchase items that not many people are even surprised when they order something and it arrives the next day. The days of waiting three weeks for your order are long gone. So why would someone order an expensive item like gold when they can wait at home in comfort? Simply put, buying gold online makes sense for four reasons: safety, convenience, speed and affordability.

When it comes to safety, there’s no question that buying gold online provides convenience. Since you can order products 24 hours a day and seven days a week, you don’t have to deal with long lines at your local jewelry store or wait until they open on another day of your vacation. You also have more flexibility than if you have to schedule delivery of your purchase and still be available when it arrives. If you need it, buy it now. The best part about buying gold online is probably its affordability.

Top Gold IRA Companies

Our recommended Providers are researched and vetted by us and many top consumer organizations. This is the short list of the most consistent companies we could come up with. Request information from them below.

#1: Augusta Precious Metals

Our Rating: 10/10

Pros

✅ ZERO complaints with the BBB and BCA

✅ Highest reputation and customer satisfaction in the industry

✅ Non-commissioned sales team

✅ Transparent pricing with up to 10 years of fees waved – with qualifying purchase.

✅ Hall of fame quarterback, Joe Montana was an actual customer before becoming their spokesperson!

Get a free gold IRA Kit now!

Call: 1-855-470-4636

#2: Birch Gold Group

Our Rating: 9.9/10

Pros

✅ Great company commitment to education and communication

✅ Impeccable customer service

✅ Silver, gold, platinum and palladium available

Cons

❌ Signup process can only be done thought a specific link

❌ Certain fees are not disclosed up front

❌ No buyback guarantee of precious metals

#3: Noble Gold Investments

Our Rating: 9.6/10

Pros

✅ One of the best no questions asked buyback programs in the industry

✅ Free delivery of your precious metals to your door at any time

✅ Over 20 years of experience in the precious metals industry

✅ Gold, silver, platinum, and palladium available

✅ One of the lowest barriers to entry – ideal for smaller investors

Cons

❌ High annual fees for low balances

Gold as a Dividend-Paying Asset

Many investors are seeking safety by investing in gold. The yellow metal has been used for centuries as a store of wealth and investment vehicle against uncertainties in global economies. Gold coins and bars can be purchased from gold dealers, and other physical gold-related investments, such as ETFs, shares in mining companies, etc., can also be found on the market. All of these can help provide some security to those looking to protect their assets from market fluctuations.

Even though gold doesn’t pay any dividends, there are other ways to invest in gold that can offer similar benefits. Gold ETFs and ETNs (exchange-traded notes) offer investors all of the advantages of physical gold ownership, but also provide other benefits such as price stability, security and low commissions. They do so by using futures contracts, which allow investors to buy or sell precious metals at current market prices without ever taking possession of them. These instruments work just like shares—you buy them on an exchange, where they’re listed alongside all other publicly traded companies. As with shares however, your investment does not entitle you to dividend payments from gold producers or anyone else.

For thousands of years, gold has been one of the most sought-after precious metals in the world. And for good reason. Unlike stocks and bonds, which rely on economic factors like GDP growth and interest rates to maintain their value, gold maintains its worth due to its inherent properties. A fundamental factor for this metal’s value derives from it being impossible to generate more of it than what already exists today. This means that if you buy some today, tomorrow, or next year, it will always be worth the same amount.

Yes, you can make money investing in gold. In fact, the price of gold has been on the rise in recent years and according to Quartz, in dollar terms, gold has done better than any other major asset class since 1980. This means that people are making money investing in gold. But there are some risks too, so it’s important to talk with an expert before deciding on what your best investment strategy should be. It also doesn’t hurt to check out industry experts like Marketwatch or sites like Investopedia for their take on how to make money by investing in gold.

Don’t forget to take into account the convenience of exchange. Currency trading and gold trading are two very different forms of investment; however, both can be great when you know what you’re getting into. When it comes to your money, it’s always important to weigh up all of the pros and cons in order to make an informed decision.

Gold has been around for as long as people have. The yellow metal has always had value, from being used to make jewelry, or being exchanged for food and supplies. Today, gold is commonly used in finance, with many companies and governments actively holding gold reserves. Not only does gold act as a useful store of value and insurance against inflation, but it also provides exposure to growing markets such as India and China that many other investment vehicles do not cover. Gold can be purchased through exchange-traded funds (ETFs) or using futures contracts; however, there are downsides to both of these options. Although ETFs offer lower transaction costs than buying physical bullion directly from an exchange, they still involve additional fees in order to hedge your exposure against fluctuations in price.

Cash does have some advantages over gold, though it has to be said that as long as you invest in gold bullion or coins, cash will not hold its value very well. Gold can be an excellent investment because of the many benefits it offers. The following are just a few reasons why investing in gold is worth considering:

-In times of crisis and downturns, people flock to gold because they believe that the economy will rebound and they want to protect their savings. In other words, during times when investments like stocks and bonds lose their value, gold prices tend to rise. And conversely when stocks or bonds prices rise, then there tends to be downward pressure on the price of gold.

Both silver and gold are considered precious metals that are used as investments. If you were to own just one, however, we would recommend silver. Below are seven reasons why:

1) Silver has increased in value over the last 10 years. In comparison, gold is still too low for it to be profitable for investment purposes.

2) Most investors don’t pay taxes on their silver gains because it falls under collectible status (when it falls under the categories of coins and bullion).

3) Silver isn’t as heavily priced-suppressed by central banks like gold has been historically. This also means that people who want to buy or sell a certain quantity of ounces of silver can do so at any time they choose which allows for greater flexibility when investing.

It can be difficult to know which type of metal to invest in at any given time. However, it is possible to make an educated guess about which type will perform better. Prices for silver and gold are often opposite in price. In general, if gold prices go up, silver prices go down. If the price of silver goes up, the price of gold goes down. The reason behind this behavior lies in the fact that both metals have industrial use and are used as money by some countries – i.e., they are considered monetary metals (though they don’t really function as money). So you might wonder: should I buy silver or gold in 2022?

There are several factors that might help you decide whether silver or gold will do better for you over time. For example, if an economic recession appears imminent, investors tend to hoard gold rather than silver. This is because it has always been used as money throughout human history – gold coins were used even in ancient China and India. At times when people expect currency devaluation, they tend to buy silver instead of gold since silver can be quickly turned into cash and doesn’t have any industrial use (gold also has some industrial use). The same rationale holds true in times of crisis when investors may opt for either metal over paper currency, especially if they think paper currency might lose its value due to potential inflation or regulation policies.

Yes, gold can potentially lose its value. But, experts predict that it will take an act of God to cause gold to lose its value in the near future. That being said, if you’ve been reading about people predicting the end of the world, then you may want to do something else with your money because a prediction like that will never come true (or at least not any time soon). And don’t forget inflation: even though gold has held its value for centuries now, it won’t always be this way. As technology and manufacturing costs drop, inflation will catch up with us eventually. However for now there are many other reasons why gold is such a great investment besides this one glaring downside…

Pingback: Can You Really Protect Your Retirement by Transferring Your 401k to Gold? - Gold IRA Rollover

Pingback: How to Convert Your 401k to Physical Gold

Pingback: How to Convert 401k to Physical Gold - Gold IRA Rollover

Pingback: 401k to Physical Gold - Gold IRA Rollover

Pingback: Pros and Cons of Gold Investing - Gold IRA Rollover

Pingback: Can You Put Gold in an IRA? - Gold IRA Rollover

Pingback: Investing in Gold IRA Funds - Gold IRA Rollover

Pingback: Gold IRA Rollover: Step by Step Guide

Pingback: Gold IRA Rollover Guide - Gold IRA Rollover

Pingback: Why a gold IRA Investment is a Smart Retirement Savings Strategy